There is a sad truth about price comparison websites – they don’t compare all providers, and they can take a considerable commission for signing you up. Where is the objectivity in that?

In short, we at CyberShack believe that price comparison websites SUCK. If anything, PCWs significantly contribute to keeping the ‘retail price’ of their providers’ goods or services high with undisclosed commissions as high as 50%. You are paying for that.

First, let’s look at the Price Comparison website’s perspective.

They feel that they are doing the consumer a service by setting up a database of goods and services (mainly services as they can make more money). In return for you disclosing what you are paying for electricity, gas, insurance (all types), mobile, data, internet, finance, credit cards, accommodation and more, they offer a so-called better deal.

Only it is not. A better deal just has to beat your existing deal – not give you the best deal.

Price comparison websites use AI algorithms with three priorities

- First, it draws from a small group of ‘partners’ that pay the PCW to market for them.

- Second, it offers you a price just below your current vendor. You must first disclose your current vendor and plan, so it knows what to offer – not the best price!

- Third, it usually offers the plan it makes the most commission from.

The AI also looks at your time on page and click-through. If it feels you are not interested/engaged, it will offer you an extra enticement to sign up.

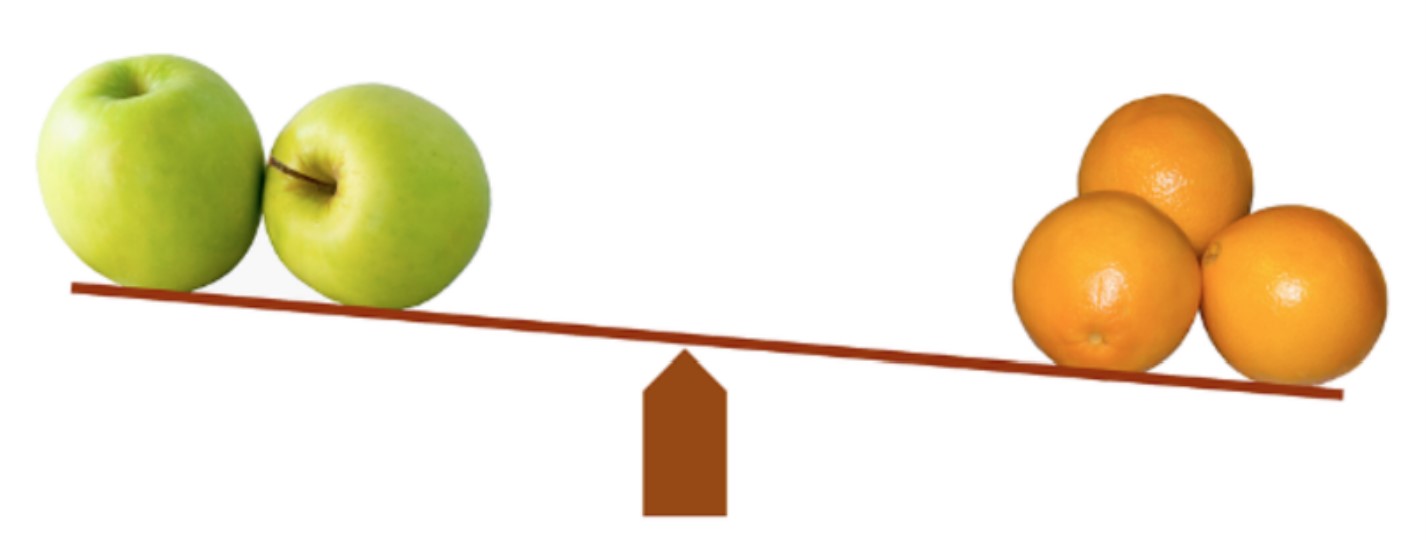

PCWs use AI to make recommendations, and it is not always objective

Price comparison websites mentioned by the ACCC

- iSelect for misleading or deceptive conduct and false or misleading representations concerning its energy plan comparison service. Compare the Market has a 35% shareholding in the company.

- Trivago for misleading customers about hotel rates.quiality and terms

- Compare the Market for its claims “We now compare more health funds than any other website in Australia” and “Compare more health funds than anywhere else”. Compare the Market is part of a company that owns Budget Direct and sells insurance and other products like Virgin Money, OziCare Insurance, 1st for Women Insurance, Oceania Insurance, and has tie-ups with ING and Qantas insurance products.

- Finder for false or misleading claims about the number of health insurance policies it compares

These are well-known names that advertise prime time. Many try to legitimise their money-making activities by publishing consumer advice, reviews, awards, etc. It is a shame our media does not see through this sham for what it is – a desperate attempt to legitimise the PCW and drive traffic to its site.

“iSelect was not upfront with consumers that it wasn’t comparing all plans offered by its partner retailers. In fact, about 38% of people who compared electricity plans with iSelect at that time may have found a cheaper plan if they had shopped around or used the Government’s comparison site Energy Made Easy.”

Rod Sims, former ACCC Chair

Nothing lifts their act like a fine and a public humiliation.

Price Comparison websites farm and monetise your data

All collect name, address, email address, telephone number, date of birth, financial details, and any other information they need to provide you with the quote. For example, if you wish to obtain a quote for health insurance, you will be asked for basic information about your family circumstances, pre-existing health conditions, and general health care needs.

They monetise that data

- Use personal information to inform you about products and services offered by the PCW and their business partners that it thinks may be of interest to you

- Let you know about other products, services, or promotional offers that it thinks may be of interest to you

- Manage relationships with its participating providers, suppliers and stakeholders (use that data to get more significant commissions)

- Analyse your interactions and use of online services to understand the effectiveness of its marketing initiatives

Things that price comparison websites don’t do

- Disclose the commission they earn from a recommendation. OK, that may be asking too much, but it is akin to cash for comments if it steers you to a vendor that pays a higher commission.

- Disclose the commission to encourage you to switch to a new provider each year as renewals only have a small commission.

- Disclose that often the recommended plans are concocted in

collusionpartnership with the vendor, e.g., not available on the vendor’s pricelist - Compare all relevant suppliers. In fact, they compare very few suppliers, especially where geographical locations can make a huge difference. For example, there are 22 energy suppliers and more than 70 plans where I live, and the best comparison was five with a total of 11 plans.

- Worse still, they base your comparison on a previous ‘bill’ that likely was terrible in the first place, e.g., easy to beat.

- Don’t look at the bigger picture. Things like when saving money may mean going solar for water heating and energy or when installing a home battery makes sense. This will become even more critical with the increasing use of electric vehicles and recharging costs. All they do is maintain the expensive status quo

The Government must act

During the 2017 Senate Inquiry into Price Comparison websites, major goods and services vendors exposed the extent of kickbacks to PCWs. One health fund was paying 46% commission for new business.

For the most part, the insurance industry felt brokers were a far better alternative as they work for the consumer to ensure the right policy at the best price. Why – because brokers are Government regulated and transparently earn their money, PCWs still are not.

In fact, the Insurance Council raised questions on claims satisfaction – high satisfaction if using a broker and low if not. It recommended that comparison websites disclose a complete list of what home, contents, or strata insurance products they consider when comparing or providing a recommendation.

Its draft recommendation 4 called for an independent insurance comparison website to facilitate more informed consumer choice. Its draft recommendation 10 states that comparison websites should disclose the amount of commission and other remuneration for each product. Brokers are obliged to do that already.

Bottom line – Australian four largest insurers back brokers over price comparison websites any day. To summarise, price comparison services only emphasise price rather than educate consumers on the insurance they require. Price comparison sites are not useful due to the sites having incomplete coverage of insurers and the differences in definitions across insurers.

CyberShack advice – do your research and deal direct

We like to travel and have been burned badly in the past by Trivago. Not only were the prices higher, but the Trivago room product was inferior, and the cancellation terms were stricter. We have consistently found dealing directly with a hotel or airline yielded a better price, better room and more favourable cancellation terms.

We tried a well-known PCW for gas and electricity and found that we could obtain a far better price for the same conditions by going direct.

And we used a PCW for travel insurance only to have the claim denied as we allegedly completed the online form incorrectly. The PCW would not give us a copy of the form. By comparison, our broker is a pleasure to deal with, and during COVID lockdowns, has saved us considerable costs.

There are some free government comparison websites that do not sell your data

Energy Made easy that covers gas and electricity

You can read the ACCC 20-page report – it is an eye-opener.

Comments