The ACCC is considering whether Compare the Market, a price comparison website, should change its name. The name implies that it compares the whole market to deliver a better deal.

Compare the Market (CTM) uses cute Russian meerkat characters Aleksandr Orlov and his Head of IT, Sergei, to push the idea that you are wasting money by, well, not comparing the market for a range of insurance and other services. Its parent company also owns iSelect, another price comparison website and many of the insurance products are also from its parent company.

ACCC Chair Gina Cass-Gottlieb announced that it is taking a renewed interest in price comparison websites.

We are concerned that price comparison websites can mislead consumers in a number of ways … We want there to be accurate representations and disclosure of commercial arrangements by price comparison websites.

What is a price comparison website (PCW)?

Back in 2022, we wrote Price comparison websites – the scourge of the internet, and it is still relevant today. We stated, ‘There sad truth about price comparison websites – they don’t compare all providers, and they can take a considerable commission for signing you up. Where is the objectivity in that?’

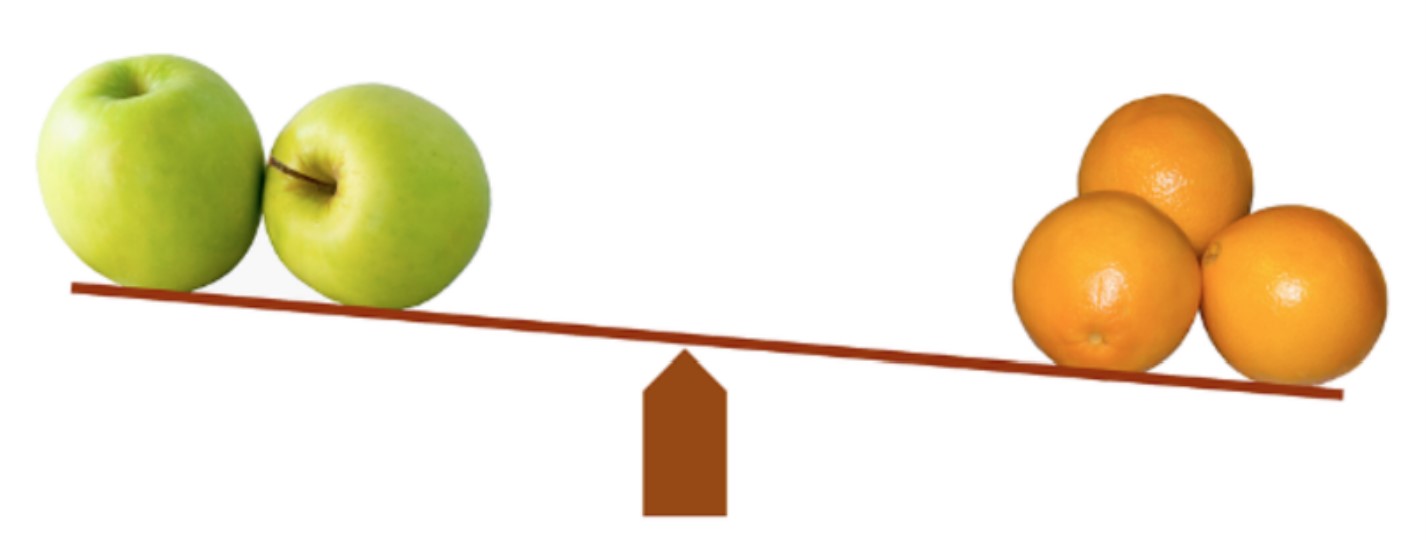

In theory, not always in practice, it is a website that enables consumers to so-called objectively compare various costs and policies on an ‘apples for apples’ basis to hopefully save money. The website usually receives a ‘click-through’ vendor payment from the initial lead (your use of the website) and a commission from any subsequent purchase made from that clickthrough (this usually involves passing the lead to a vendors’ call centre).

Websites use various tools to track interest and purchases, including cookies, transparent GIFs, logins (most are mandatory), website visit tracking, and unique incentives to use their services.

Most offer personal insurance comparison services, including car, home, van, health, life, income protection, pet, travel and over 50s. Some also provide comparisons for

- Energy/Utilities

- Broadband and digital TV

- Roadside assistance

- Money transfers

- Fuel prices (a thinly disguised push notification advertising app)

- Financial products, including home and general loans, credit cards, current accounts and mortgages.

Most services require you to establish an account so it can track you. In CTM’s case, you are encouraged to download the ‘Simples App’. These have privacy implications (see Privacy Polices later).

Sounds good. What is the harm?

If a PCW’s self-interest (the need to earn money) was not paramount, these sites would be pennies from heaven. However, as the UK Competition and Markets Authority found in 2018, CTM broke the law by preventing home insurers from offering lower prices elsewhere. This has resulted in people paying higher premiums than they need to. In November 2020, CTM was fined £17.9 million (A$35m) for deceptive conduct.

Additionally, some PCMs are owned by some of the products they compare.

This is one of oh, so many dodgy deals that PCWs engage in. Leading companies like Compare the Market (£17.9m subsequently overturned on technicality appeal) ), Trivago (A$44.7m), Finder ($10,800), CompareClub ($13,320) and iSelect ($8.5M) have paid fines. Expect far more actions, but remember that these get tied up in Court for several years.

The European Trade Commission has indicated that it plans to crack down on PCWs.

Most promise a comprehensive comparison

As the ACCC (Australian Competition and Consumer Commission) found, there can be more downsides than perceived benefits:

- Most only compare a small number of all the possible vendors, especially in regional areas.

- The savings achieved by using the comparison service were often negligible and often cost more than existing vendors.

- Comparisons often used the full retail rate of the existing supplier against the lower introductory trial rates that reverted to full price.

- Comparison services were not always unbiased, impartial, or independent.

- New entrants could purchase value rankings to gain business.

- PCW could influence churn and burn rates (and gain higher new business commissions) by driving you to switch vendors yearly.

CTM’s fine print says it all, ‘We don’t have access to all of the products available in your area: we do not compare all brands in the market, or all products offered by all brands. At times, certain brands or products may not be available or offered to you. Learn more.’

Concerns about behind-the-scenes conduct broadly relate to:

- Undisclosed commercial relationships affect recommendations to consumers.

- Vendors pay PCWs to be on the site

- Some vendors own PCWs.

- Content and quality assurance of product information (often not seen until a product disclosure statement arrives with a bill).

- The amount of personally identifiable information requested can include full name, date of birth, email and postal address, driver’s licence, passport number, copies of utility accounts or insurance renewal bills, financial details, medical history, and so much more.

- Many PWC users report an enormous increase in spam and cold calling.

- Wide disparity between PWC details and the final purchase.

- No responsibility for the quality or performance of offers and policies.

- Sell and forget – PCWs are not the supplier.

- Offering incentives like cash-back or extra discounts that don’t materialise.

In short

- PCWs do not compare the entire market – only those that pay to be included.

- You can be influenced to select a supplier that makes the PCW more revenue.

- As these websites exert more influence on the market, vendors may be forced to restrict more favourable plans.

Back to the Meerkats!

Aleksandr Orlov and Sergi don’t reveal anything about CTM’s operations, yet the clever marketing has made it a substantial player in the UK and Australia.

Closer investigation reveals that CTM receives (this list is not exhaustive):

- 25% of the first-year health insurance premium and 6% of subsequent years. This could lead to CTM suggesting an annual swap to earn new, higher business commissions.

- 20% of the travel and home insurance premium plus renewal commissions.

- Up to $250 per sale from car insurance plus renewal commissions

- Up to 60% of the entire lifetime premium for life insurance.

We can only assume that competitor iSelect (owned by CTM’s parent company) receives similar amounts.

CTM’s parent company owns several insurance companies, which CTM and iSelect compare.

Meerkats are not the only not-so-secret weapon. Celebrities like David Koch (former Sunrise host) have been given a fancy title – he is Economic Director – to add local credibility. Note that this is not Koshie’s real job – that is Koshie’s Business Builders. You would think he would know better after his considerable experience in media exposing ‘cash for comments’ and scams using his name and image.

Read a few TrustPilot ratings.

Many prominent vendors don’t like Meerkats

In a Senate inquiry into Australia’s general insurance industry, Allianz stated, ‘PCWs charge a fee for their service and therefore impose an unnecessary additional distribution cost that would need to be passed on to our customers in the form of higher premiums.’

Market researcher IBISWorld reveals that health fund giants Bupa and Medibank hold a combined market share of over 50%. Similarly, Insurance Australia Group (IAG) and Suncorp hold combined shares of over 50% in car and home insurance, and the top four companies in travel insurance dominate with an 85% market share. Significant insurers, including GIO, AAMI, NRMA, RACV, SGIC, SGIO, Allianz, or QBE, disdain and will not support PCWs.

It is not just Meerkats

There is a plethora of PCWs.

Finder is on a growth curve, offering additional services like so-called independent reviews and paid-for comments (advertorials). Its rankings and awards can have a vendor cost. Read ProductReview ratings.

Canstar offers similar services, but its ProductReview rating is poor. It also runs a series of awards with vendor costs. “Canstar Blue said Maccas had the best coffee. It turned out Canstar Blue had sold the award to Maccas…”

WhistleOut focuses on NBN, 5G, and Mobile phones and runs awards. It also has an affiliate program where other websites can access its database and receive a referral fee. As it is focuses on one segment—communications—it is generally accurate. The only criticism is that comparisons are often made on limited offers that revert to full price after a short trial period. While these are seen as ‘deals, ‘ they skew the real price.

PWCs suck. Why?

To Joe and Jane Average, PCWs look good. There is an oblique, inferred, often unrealised expectation (never say promise, or you will cop a fine) that they may reveal a ‘better deal’ than you are presently paying. Many have so-called helpful calculators that you can use to enter your details and past bills, giving the PCW AI all it needs to reel you in.

The AI that uses an algorithm predicated on three things:

- It draws from a small group of ‘partners’ that pay for the privilege of PCW listings.

- Offers you a price that is just below your current vendor’s. As you must disclose your current vendor and plan, it knows what to offer—not the best price!

- Then, subtly steer you to the plan for making the most commission.

The AI looks at your time on the page and click through. If it feels you are not interested/engaged, it will offer you an extra enticement to sign up.

CyberShack’s view – Compare the Market is just another opportunistic price comparison website.

OK, the upside is that someone else has collected the data and presented it in a digestible format. And as you must expect, that costs money – especially the care, feeding, and extensive advertising of meerkat characters Aleksandr Orlov and his Head of IT, Sergei or David Kosh.

PCWs may claim that the vendor pays them to market so it does not cost the vendor labour, advertising, etc. But the fact remains that there is enormous profit in most of these services, and direct-to-market (business-to-consumer) can and do offer better deals if you do your own research.

Consumers must understand that there are other factors at play, and PCWs use every trick in the book to get you to use their services.

There are tricks that can end up costing you more. For example, I used CTM on energy, and it showed 10 (including two each from two companies) that were way more expensive than the 23 plans/providers in my area (Energy Made Easy Government website), offering up to 50% lower prices. Plus, the incessant email spam, SMSs and cold calls to get me to switch are driving me mad.

Privacy – you have none

Below is CTM’s privacy policy (and by inference, iSelect is similar). It is 3478 words, and here are a few high (or low) lights. No thinking person should accept these terms.

It collects

Name, address, date of birth, gender, insurance history, employment information, marital status, proof of identification information (e.g. driver’s licence, passport details), bank account details, social security information, Medicare number, details about the risk you want to insure, details regarding your financial circumstances and future requirements, details about your property values, and your contact details.

In some cases, we may collect information that is usually non-personally identifiable (such as location data, data about personal attributes or online identifiers) but that, taken together with other collected data, may identify you, either directly or indirectly.

It also aggregates your social media and other brokered information such as credit rating.

From cookies and trackers, it gains the IP address, the device you use to access our website or social media, your location, the sites you visit immediately before or after our website and the frequency and duration of your interactions with our website.

We may track activity relating to your interaction with our email communications and with links embedded in email communications and our website or social media.

That is a hell of a lot of information. How is it used?

That would be fine if it were just to communicate with you about your policy (for example, renewals, etc.). But no. It is also for Optimising and enhancing your services (upselling) and marketing and advertising.

Hang on, it is a huge list:

- to provide you with our services and products, including via our website or via our call centre;

- to provide to our business partners or participating suppliers so that they can (where you have agreed) provide you with updates or information about their products and services and provide you with reminders;

- to assist with any enquiry you make about home loans;

- to provide to our service providers so that they can provide us with services that assist us to run our business and the websites;

- to reconcile transactions with our business partners or participating suppliers that supply you products because of our services;

- communicate with you about our loyalty program;

- to provide to our service providers who we engage to provide you with your prize if you win a promotion.

- to send you a summary of your quote and comparison results;

- to administer competitions and promotions;

- to send special offers or reminders;

- to seek your opinions and feedback; and

- to telephone you about the services and products we offer

- to prevent abuse and fraud;

In conjunction with other information, for analytical and statistical purposes;

- to personalise and customise your online experience, including advertisements and content;

- and for other administrative and internal business purposes.

Advertising

- We use your personal information to market and advertise our business and products and services to you.

- Your information may also be used to customise and display advertisements and content for you.

- We may use various services or organisations to analyse collected data about your interaction with our website, services or other aspects of our business. The information that is collected is not generally personally identifiable as it is aggregated data that does not identify any individual user.

- Third party organisations may share user information they collect from our website with other analytics companies that collect, analyse and report on data obtained from their clients. In some cases, the non-personally identifiable information collected from our website or services may be linked with information

- collected by a third-party source to become personally identifiable. We will not link or merge information collected by us with information collected by third party organisations without you consent. However, Google, Facebook or other third parties may merge or link your information if you have provided your consent for them to do that.

By using our website, call centre and services, you consent to:

- the collection of data by our ad servers or third-party affiliates, or the transfer of information to them, wherever necessary, for optimisation and enhancement of our website and services.

- to tailor the content and advertising that is delivered to you;

- receiving email or SMS communications from us. If you provide us with a false email or mobile number, we may be unable to provide you with the requested information or your quote summary,

- personal information may be accessible to a third party.

- To safeguard personal information that may be accessible from communications from us, we recommend that you only provide us with contact details over which you maintain

- access and control.

- You can opt out of marketing and advertisements at any time.

Compare the Market, Compare the Market, , Compare the Market, , Compare the Market,

2 comments

Sandra Frank

When we received our car insurance renewal notice in January, the premium had risen from $840 to $1,335 – it is an understatement to say that we were shocked!

Our car is 2016 Pulsar and we are both in our 80’s and don’t drive all that much, so we decided to ‘let our fingers do the walking’.

Tried “compare the market” but they were narrow in the selections and no help, tried iSelect and found Woolworths “drive less, pay less” and now for a fully comprehensive cover we have paid $417!

We are thrilled – so some of the sites are worthwhile, try them all.

Ray Shaw

iSelect is owned by Compare the Market. Woolworths cover is excellent and you would be better dealing direct with it in the future.