VPP Part 2, or Virtual Power Plants using your battery to supply peak grid demand, is the outcome of a CyberShack deep dive into the practice. All we can say is we don’t see the appeal.

Labor’s Cheaper Home Batteries Program – is it worth it? has just been released, and we have diligently analysed it. As we predicted, batteries and inverters must be compatible with Virtual Power Plant Control VPP – Beware of the solar battery trap. It is not compulsory to join a VPP – yet.

The VPP theory

Australia is generating more rooftop solar electricity at times than from coal and gas plants.

The Federal and some State governments and the Australian Energy Market Operator (AEMO) see VPPs as a cheap and easy way to harness consumer-generated power to meet peak energy needs and meet energy Paris Accord commitments.

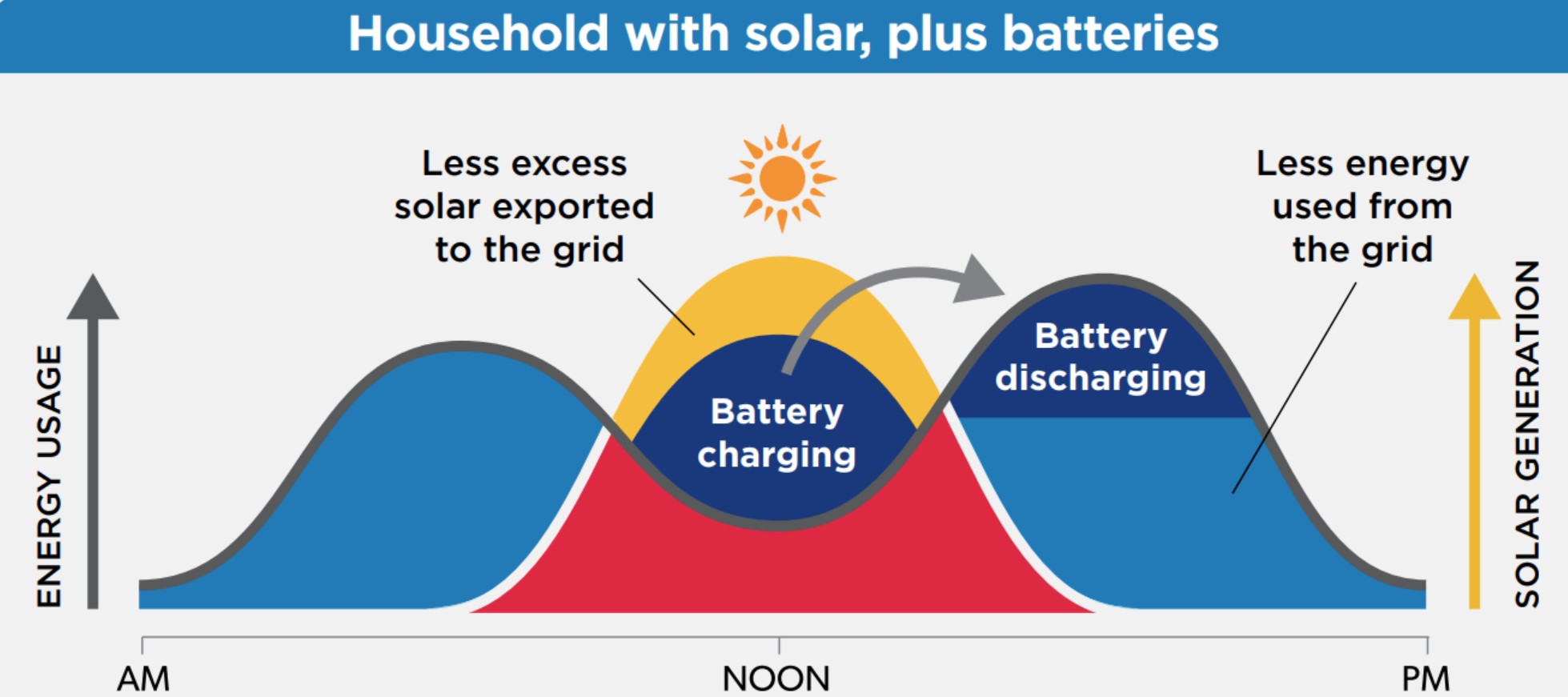

But the Catch-22 is that solar energy is generated in the middle of the day, but most of it is needed in the evening (peak period). Ah – we need your battery.

Australians don’t trust the government or the energy industry

Despite the government’s push, Australians aren’t signing up to VPPs at the rate needed to meet their climate targets. About 140,000 home batteries are installed in Australia, and fewer than 20% are connected to a VPP. The Government’s answer is to spend your money to entice 3.5 million more people to buy batteries.

The Government has just assumed consumers would sign up, but they’ve underestimated that consumers don’t trust it or the energy industry.

I am sure some of you have had reasonable experience with battery makers like Sonnen managing your battery. Sonnen became your electricity retailer. It controlled the battery and used it as part of a Virtual Power Plant. In return, Sonnen offered a flat monthly energy bill (which varied between $42 and $62), and there were penalties for not providing enough feed-in or excess grid use.

But SonnenFlat is no longer available. Forums suggest that the scheme was not financially viable and did not make that much financial difference compared to a self-managed battery.

VPP Part 2: You pay for the battery, and the VPP profits from it.

This iteration of VPP is all about using your expensive battery to make the VPP provider money. Ironically, batteries have suddenly jumped in price. One reader found his current quote for $4800 had jumped to $6,900 before the 30% rebate, or $4,830! The company is pocketing the benefit via increased installation charges and admin fees.

There are about 18 VPP ‘products’ recognised by NEL (National Electricity Laws)

These include AGL, Actew, Origin, Amber, Energie Australia, Diamond Energy, Globird, Discover Energy, Simply Energy, Energy Locals, Diamond Energy, and ENGIE and more. VPPs will breed like rabbits.

Q: Why is this a problem? A: There are no appropriate regulations!

Virtual Power Plants (VPPs) are not governed by dedicated regulations. They must comply with existing National Electricity Laws (NEL).

We could not find a definitive copy of NEL because each state has adapted rules adopted by South Australia in 1996, well before VPPs were even considered. In any case, NEL covers upper-level frameworks that include registration and participation in the wholesale and retail markets, metering arrangements, and system security obligations. VPPs are the bottom feeders.

In essence, all a VPP must do is obtain VPP cloud software (all use pretty much the same off-the-shelf package) to connect energy assets and control hardware (rooftop solar and batteries) and allocate power through aggregation and forecasting for the entire subset of energy hardware it controls.

NEL does not cover commercial terms

We analysed the providers’ offers on 15 June. We used an Excel spreadsheet that can be downloaded courtesy of SolarQuotes.

- Many lock you in for at least a year, and some for five years, especially if there is a battery lease involved.

- If there is an easy opt-out, it is at the expense of incentives.

- VPP subsidies (if any) are small amounts on top of some State incentives. Some offer limited free or lower-cost electricity at shoulder or off-peak times.

- Most lock you into a participating energy retailer (because they own most VPPs).

- Most charge you standard energy prices when you use grid power. Discounts are often limited to a low kWh usage per quarter.

- Most pay standard Feed-in tariffs (FIT 5 cents per kWh, which is stuff all).

- A few pay more FIT at peak and critical grid times

- A few pay no FIT

- Only specified batteries and inverters from Enphase, Tesla Powerwall, LG Chem RESU, Sonnen, AlphaESS, and Huawei are supported (see the Excel list), so beware of offers for cheap batteries.

- Most will leave 20% capacity for use by the owner*

* We spoke with four VPPs about battery reserves. All were non-committal, saying that they would usually leave enough to meet typical reserve requirements, but not one would commit to what that meant. One said they aim for 20%, but can take the lot during VPP ‘events’.

Lithium-ion batteries usually have a 20% to 80% manufacturer’s recommendation, with warranties based on these battery cycles. A completely exhausted Li-ion battery can mean the system does not automatically restart when the sun shines and may require a service call.

More expensive LiFePO4 (sometimes called LFP) AC batteries can operate from 0 to 100%. If using micro-inverters, they do not require a ‘restart’, although it is recommended that you set the lower level at 10%.

Here is Origin’s customer agreement, which is reasonably typical of most VPPs. It contains a few traps, including allowing it to share your data.

If a VPP fails, and they do

VPPs are your new electricity retailer. They buy at wholesale rates and sell to you at retail. The wholesale spot price varies every 5 minutes and can be very volatile, so, as a business risk, VPPs play a constant game of Russian Roulette. Smaller VPPs are often most impacted, as Sonnen found.

Even the USA’s largest VPP, with 16,000 homes in California, could not exist without extensive subsidies from the Government’s Demand Side Grid Support Program. It has only survived because all new batteries are auto-enrolled (opted in) to its VPP. In Australia, the law states you must manually opt in.

The main impact of VPP failure has been reverting to a self-managed battery and contracting with an electricity retailer for grid power.

But where a no-cost upfront (hidden battery lease) or other incentives based on future battery performance are concerned, it appears the consumer is wholly liable to make good those costs on demand. Liquidators are not backward in demanding that you meet the contingent liability terms.

There are reports of VPPs switching off batteries to pressure delinquent payees. There are reports of registered caveats over batteries preventing the sale of a home.

The future of VPPs

According to recent data from SunWiz, consumers remain unconvinced. Most AEMO-registered VPPs remain small (in the grand scheme of household numbers), while others have gone backwards or been wound up.

Larger energy retailers are relentlessly pushing VPPs as part of a package to lock you in. They can offer battery payment plans and incentives, lowering households’ up-front battery costs. They tell you that you can make more money, conveniently forgetting the capital or hidden lease cost you incur over time.

As we have always maintained, it’s a scheme to use your money/assets to profit others.

Until VPPs can overcome the challenge of making enough money from your asset, they won’t be consumer-focused for your benefit. Germany found this and has decided that community batteries are the best consumer-focused answer.

That will require utilities and aggregators to recognise that customers have different values and intentions than VPPs, which are just adding an extra layer of complexity to an already overly complex system.

There may be one hope for VPP. There have been tests using AI to manage the VPP at the household level, with the emphasis on what works best for the home. Early results, however, indicate that it is an either-or situation. Either the VPP makes money, or you have good solar management to minimise grid needs.

Another issue identified by AI is that a large proportion of rooftop solar systems don’t produce enough energy to charge a battery. Solar owners need to check if their system is constantly exporting at least 10 kWh a day before considering a battery.

Interesting random facts we discovered in the deep dive

Daily grid supply charges range from $1 to as much as $3 apply. The energy retailer gets their share regardless. They won’t countenance a discount based on your reduced grid usage.

A VPP is solely about using your battery during peak periods and emergency events. It is not about your overall solar panel production and daily home use or feed-in. VPPs have been lobbying to use that solar feed-in as well, and AMEO is considering it.

Networks have a mandatory ‘backstop mechanism’ to stop excess feed-in at any time in South Australia, Victoria, Queensland, Western Australia, and soon, New South Wales. This will materially change the rationale for a battery from export to self-consumption.

You must have a fixed broadband service at the Installation address with reliable and consistent Wi-Fi connectivity.

VPP participants often say that their batteries are most drained from 4 to 9 PM, resulting in two outcomes: having to pay peak grid power rates during this period and not having enough power to get through the night. Most batteries have to be recharged at shoulder or off-peak rates.

VPP participants say that the battery, when not used by a VPP, discharges to cover your night use, often having some left over the next day. When used by a VPP, the battery is ‘hammered’, drawing the maximum kW it can provide, often exhausting the battery in an hour or so.

VPP participants often lament that with cheaper DC kWh batteries, they lose 25-40% after it is inverted to AC for the grid. For example, 1 kW DC only yields 600-750 W AC. Conversely, if they have a DC battery and import AC, and it is inverted to DC to charge that battery, they are paying 25-40% more for that. A double whammy.

Long-term participants now state that they did not realise they were selling energy from the battery at a lower rate than what they are paying to buy energy from the grid. If your battery is meeting your needs for backup and evening power, then joining a VPP does not make sense.

Long-term participants confirm that the warranty is based on cycles, and VPP can add an extra cycle each day, shortening battery life by years. Apparently, only Tesla will honour the full guarantee when it is in one of its VPP programs.

VPPs have been hacked by state actors, and the entire VPP grid has been shut down with payment demands to reinstate the systems. This has happened in the UK, Europe, the USA and Japan. Cybersecurity experts are highly concerned that cheap inverters and batteries may have embedded hardware backdoors or act as gateways to infect and take over home networks.

In NSW, a monitored smoke alarm is required for indoor (garage) installations. (Battery installation incentive).

VPP Part 2, VPP Part 2, VPP Part 2, VPP Part 2, VPP Part 2

1 comment

Paul

Great article, well written, eye opening facts well presented. Good helpful information, thank you.